fit on paycheck stub

FIT stands for federal income tax. A company specific employee identification number.

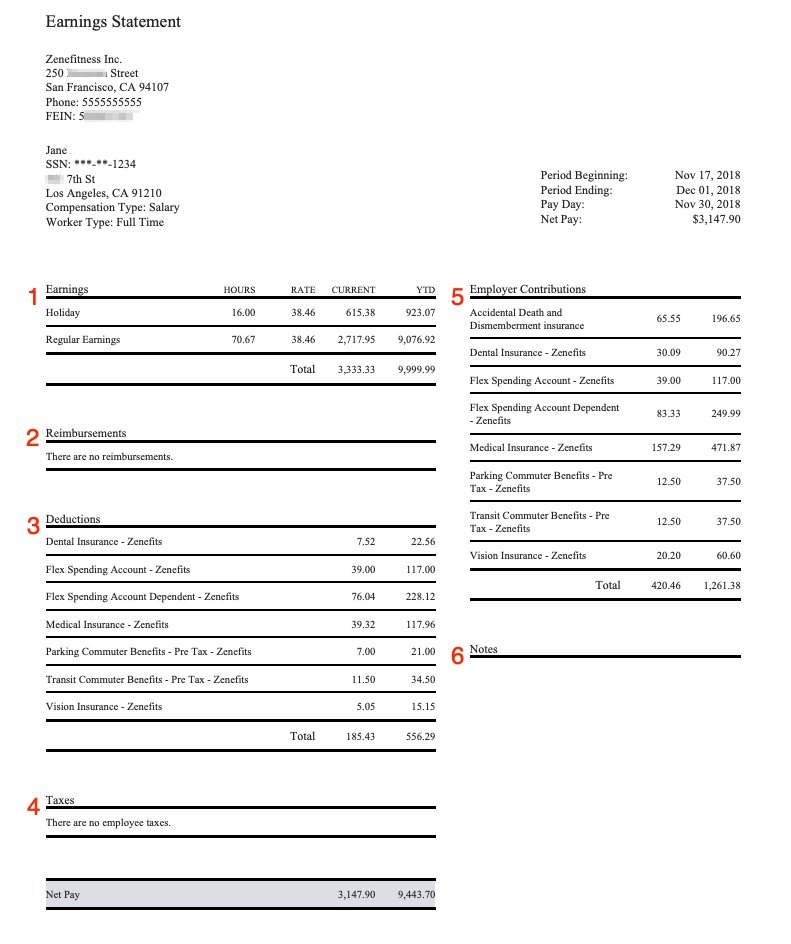

What Does A Pay Stub Look Like Workest

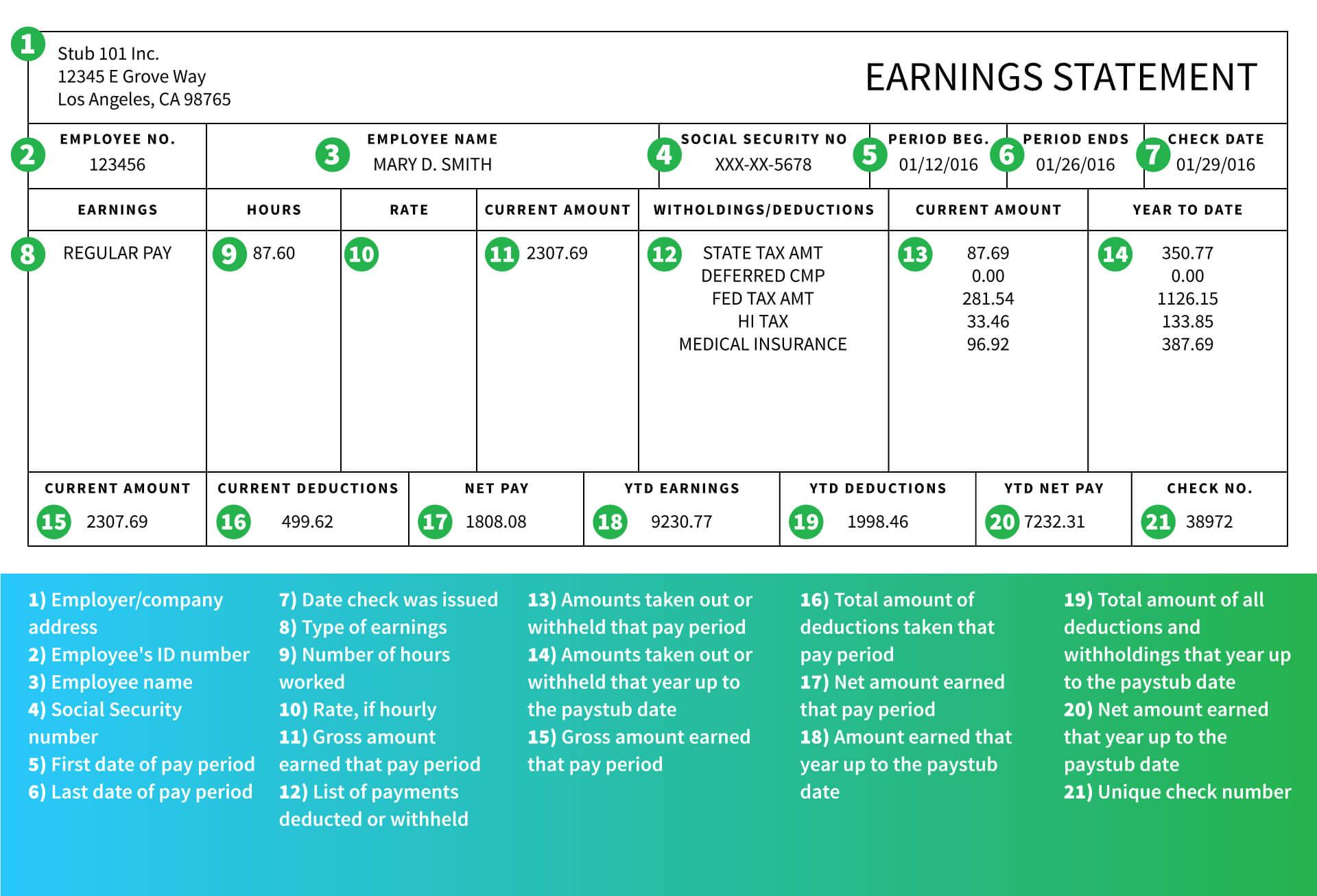

General Pay Stub Abbreviations.

. This is the initial amount earned by an employee prior to implementation of deductions by an employer. Personal and Check Information. The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may.

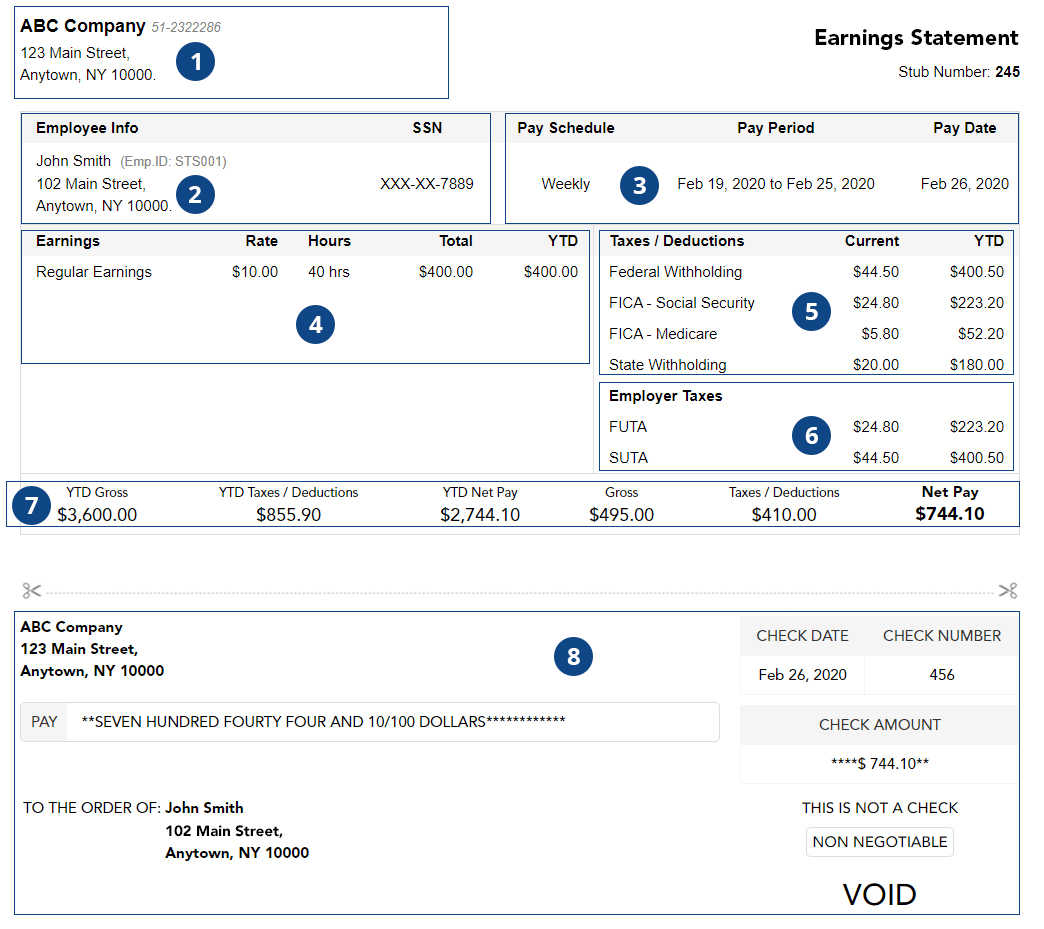

While the task of figuring out FIT withholdings for your employees may seem tricky with the help of Block Advisors payroll service or payroll software like Wave your payroll to-dos just got easier. Take a look at your pay stubany amount labeled as FICA is a contribution to those two federal programs. The paycheck stub header is where youll find your name and address pay period the address of your company or employer and your Social Security number.

Federal Income Tax. Your pay stub will also show how much youve earned during the year so far and for that pay period. The name of the Employee.

On your pay stub youll see some common payroll abbreviations and some that arent so common. The rate is not the same for every taxpayer. Withholding is one way of paying income taxes to the.

The two categories of pay found on a paycheck. You pay 62 of your income to Social Security SS. Fit stands for federal income tax withheld.

I expected - for a two week pay period - to get around 1800 but the deductions included 79125 for CT SIT 38462 for FIT 3625 for MCEE and 105 for TSSE - the last two deductions I have no clue. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. Decoding Pay Stub Abbreviations.

Here are some of the general pay stub abbreviations that you will run into on any pay stub. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

What does fit mean on a payroll check stub. You are going to see several abbreviations on your paycheck. Paycheck Stub Abbreviations for Earnings.

FIT on a pay stub stands for federal income tax. This is the amount. An employees pay stub is simply a part of the paycheck.

FIT Fed Income Tax SIT State Income Tax. What is the website for Outback employees pay check stub. On a pay stub this tax is abbreviated SIT which stands for state income tax.

TDI probably is some sort of state-level disability insurance payment eg. Other groups such as. I just received my first paycheck at a new job I started two weeks ago I have a 65000year salary - the base earnings for 40 hours is 1250.

The information on a paystub includes how much was paid on your behalf in taxes how much was deducted for benefits and the total amount that was paid to you after taxes and deductions were taken. The rate is not the same for every taxpayer. This is the amount of money earned during the pay period.

Fit stands for Federal Income Tax Withheld. Some are income tax withholding. SSN Social Security number.

This is just a way to save time and space on your pay stub. Your net income gets calculated by removing all the deductions. FIT is applied to taxpayers for all of their taxable income during the year.

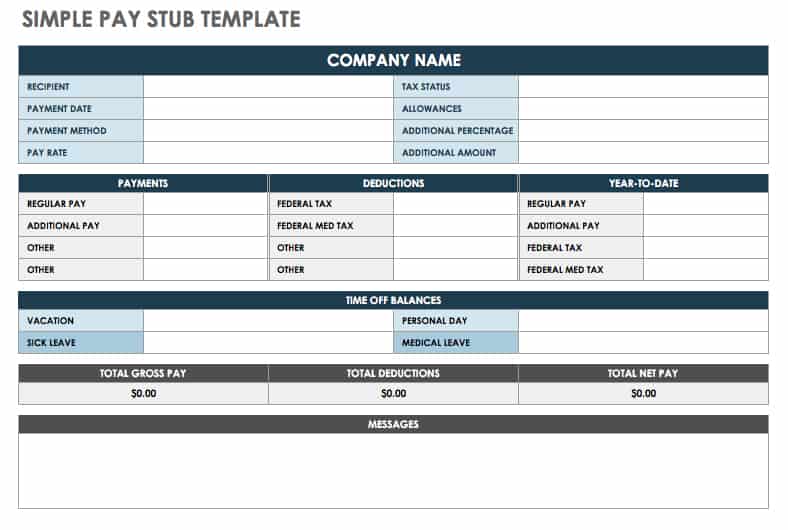

What is the website to print out my check stub from Outback. Paycheck stubs are normally divided into 4 sections. Heres the lowdown on FICA.

Some of the details include. FIT is withheld from an employees paycheck based on the amount of their federal taxable wages. The Employees social security number.

A paycheck stub summarizes how your total earnings were distributed. These items go on your income tax return as payments against your income tax liability. Here is a list of the abbreviations youll usually find in the header of your paycheck stubs.

Some entities such as corporations and trusts are able to modify their rate through deductions and credits. The pay stub contains a lot of details about the salary received. What doesfitmean on a pay stub.

Some check stubs break out Social Security and Medicare payments to show you how much youre contributing to each fund. Below are some items that are usually listed on a pay stub. FIT is applied to taxpayers for all of their taxable income during the year.

But when you are trying to decipher it all it can look pretty intimidating. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes.

Free Pay Stub Templates Smartsheet

What Everything On Your Pay Stub Means Money

Organisation Pay Stub Template Word Apple Pages Pdf Template Net Payroll Template Templates Free Organization

Decoding Your Pay Stub Infographic Money Management Decoding Understanding Yourself

Independent Contractor Pay Stub Template Lovely Free Paystub Generator For Self Employed Fill Line Best Templates Templates Powerpoint Timeline Template Free

A Guide On How To Read Your Pay Stub Accupay Systems

Pay Stub Copy Generator Pdfsimpli

Understanding Pay Stub Understanding Paycheck Stub

Is Typically Provided As Documentation Of Payment De Check Stub Template Abr A Pay Stub Or Paycheck Is Document Word Template Statement Template Templates

Quickbooks Pay Stub Template Seven Things You Won T Miss Out If You Attend Quickbooks Pay St Payroll Template Word Template Templates

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Canadian Check Pay Stub Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Template Net Templates Canadian Excel

Deluxe Paystub Paycheck Statement Template Doctors Note

How To Read A Pay Stub Gobankingrates

Different Types Of Payroll Deductions Gusto