lincoln ne sales tax rate 2018

For tax rates in other cities see Nebraska sales taxes by city and county. Lincoln NE Sales Tax Rate.

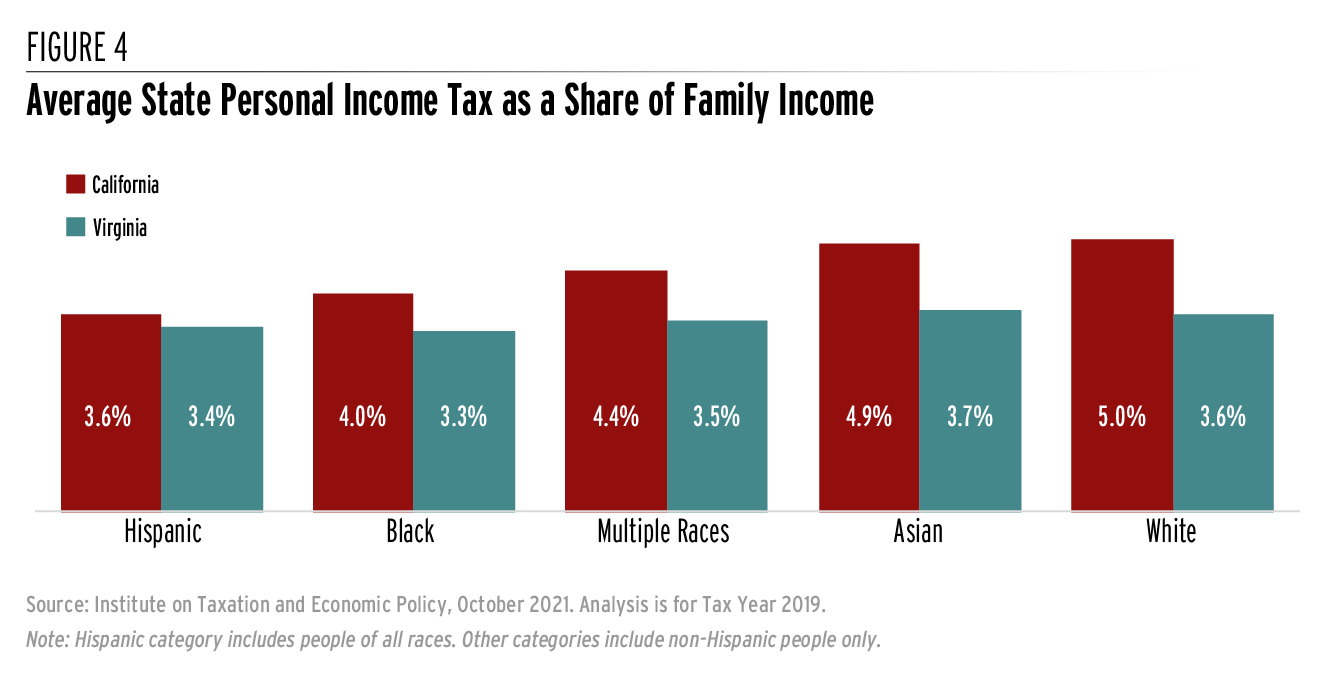

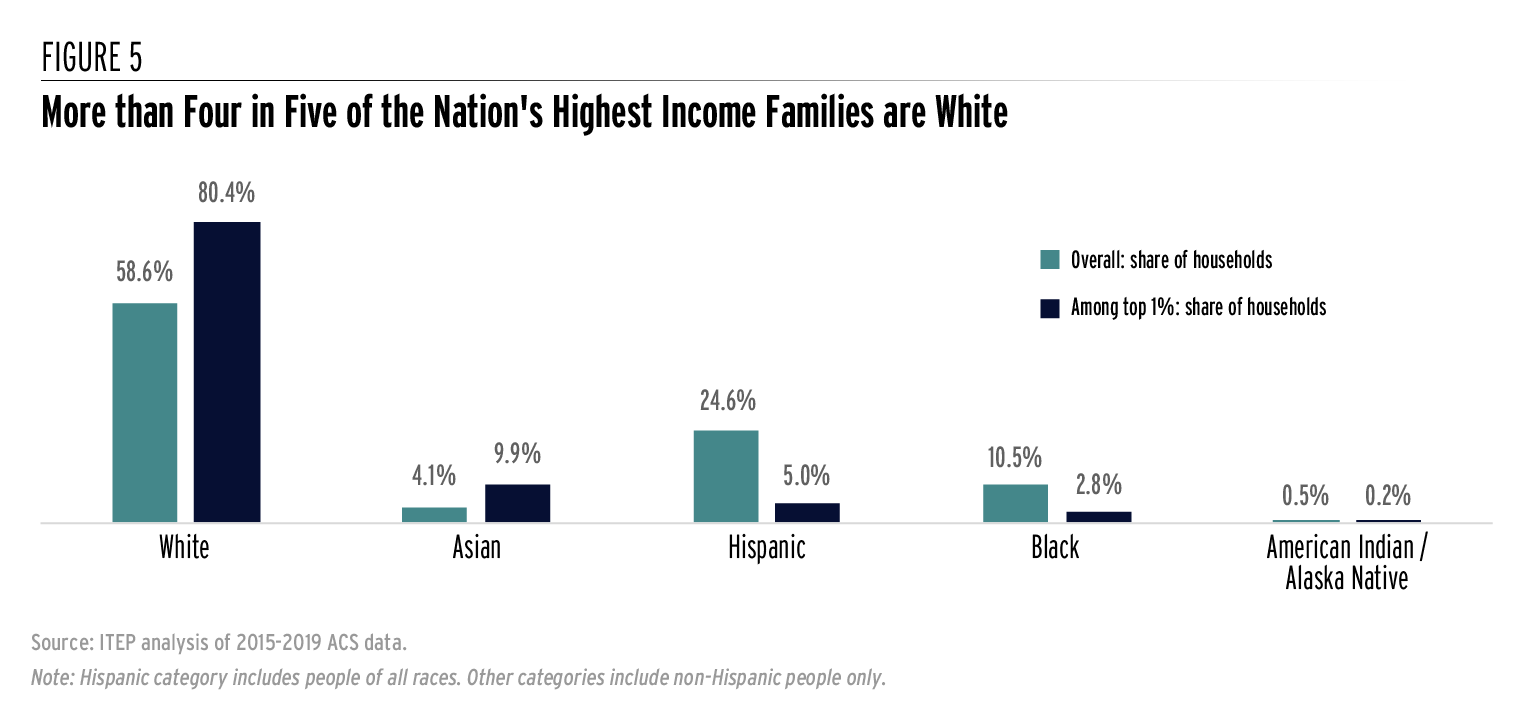

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

. The 2018 United States Supreme Court decision in South Dakota v. The 2018 United States Supreme Court decision in South Dakota v. FilePay Your Return.

The local sales and use tax rate in Chadron will increase from 15 to 2. NE Sales Tax Rate. Local sales and use tax rate changes have been announced for Nebraska effective October 1 2015.

The County sales tax rate is 0. Fast Easy Tax Solutions. A new 05 local sales and use tax takes effect bringing the combined rate to 6.

Ad Find Out Sales Tax Rates For Free. 2018 Charitable Gaming Annual Report. The 7 sales tax rate in Lincolnton consists of 475 North Carolina state sales tax and 225 Lincoln County sales tax.

Sales Tax Rate s c l sr. Did South Dakota v. Has impacted many state nexus laws and sales tax collection requirements.

The 675 sales tax rate in Lincoln consists of 625 Texas state sales tax and 05 Lee County sales tax. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor. 800-742-7474 NE and.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. The County sales tax rate is. Has impacted many state nexus laws and sales tax collection requirements.

There is no applicable county tax or special tax. The North Carolina state sales tax rate is currently. You can print a 725 sales tax table here.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. In Lincoln the local sales and use tax rate will jump from 15 to 175. Lincoln NE Sales Tax Rate.

The Nebraska sales tax rate is currently. There is no applicable city tax or special tax. Please select a specific location in Nebraska from the list below for specific Nebraska Sales Tax Rates for each location in 2022 or calculate.

The minimum combined 2022 sales tax rate for Lincoln Massachusetts is 625. More are slated for April 1 2019. This is the total of state county and city sales tax rates.

What is the sales tax rate in Lincoln Massachusetts. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton.

Average Sales Tax With Local. Lincoln has a 5 sales tax rate or 25 for most businesses. 1 2020 Deshler will collect a new 1 sales and use tax while Unadilla will collect a new 15.

January 2019 sales tax changes. The Lincoln sales tax rate is 0. You can print a 7 sales tax table here.

There is no applicable city tax or special tax. McCook NE Sales Tax. Streamlined Sales Tax Central Registration System Certificate of Compliance 07302021.

Wayfair Inc affect Nebraska. Notification to Permitholders of Changes in Local Sales and Use Tax Rates. Did South Dakota v.

Nebraska has a 55 sales tax and Lincoln County collects an additional NA so the minimum sales tax rate in Lincoln County is 55 not including any city or special district taxes. Lincoln County NE currently has 1041 tax liens available as of February 24. The 2018 United States Supreme Court decision in South Dakota v.

The Lincoln sales tax rate is. The Massachusetts sales tax rate is currently 625. La Vista NE Sales Tax Rate.

Lexington NE Sales Tax Rate. The Lincoln County sales tax rate is. Automating sales tax compliance can help your business keep.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. Groceries are exempt from the Nebraska sales tax. 1 the Village of Orchard will start a 15 local sales and use tax.

There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825. Sales Tax Rate Finder. The Lincoln sales tax rate is.

The Nebraska state sales and use tax rate is 55 055. To review the rules in North Carolina visit our state-by-state guide. 025 lower than the maximum sales tax in NE.

Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state. This table shows the total sales tax rates for all cities and towns in Lincoln County including all local taxes. The Nebraska state sales and use tax rate is 55 055.

Sales and Use Taxes. So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the municipality. For tax rates in other cities see North Carolina sales taxes by city and county.

IRS Publication 3079 Gaming Publication for Tax-Exempt Organizations. Several local sales and use tax rate changes took effect in Nebraska on January 1 2019. 800-742-7474 NE and IA.

Motor Fuels Tax Rate.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Gross Receipts Location Code And Tax Rate Map Governments

Why Households Need 300 000 To Live A Middle Class Lifestyle

General Fund Receipts Nebraska Department Of Revenue

Why Households Need 300 000 To Live A Middle Class Lifestyle

Corporate Tax In The United States Wikiwand

Corporate Tax In The United States Wikiwand

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Corporate Tax In The United States Wikiwand

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep